![جاهوا حافظة ايباد برو 12.9 2022/2021/2020/2018 مع حامل قلم [تدعم شحن القلم الجيل الثاني] حافظة رفيعة وخفيفة الوزن شبه شفافة ثلاثية الطي مع خاصية الاستيقاظ/النوم في السيارة - ارجواني : Amazon.ae: كمبيوترات جاهوا حافظة ايباد برو 12.9 2022/2021/2020/2018 مع حامل قلم [تدعم شحن القلم الجيل الثاني] حافظة رفيعة وخفيفة الوزن شبه شفافة ثلاثية الطي مع خاصية الاستيقاظ/النوم في السيارة - ارجواني : Amazon.ae: كمبيوترات](https://m.media-amazon.com/images/I/41UXfxGCvXL._AC_.jpg)

جاهوا حافظة ايباد برو 12.9 2022/2021/2020/2018 مع حامل قلم [تدعم شحن القلم الجيل الثاني] حافظة رفيعة وخفيفة الوزن شبه شفافة ثلاثية الطي مع خاصية الاستيقاظ/النوم في السيارة - ارجواني : Amazon.ae: كمبيوترات

جيتك حافظة لجهاز ايباد برو 11 انش (موديل 2022/2021/2020) مع حامل قلم، تدعم شحن القلم الثاني، غطاء تابلت رفيع مع ظهر ناعم من البولي يوريثين الحراري، خاصية التشغيل/السكون التلقائي (اسود) : Amazon.ae:

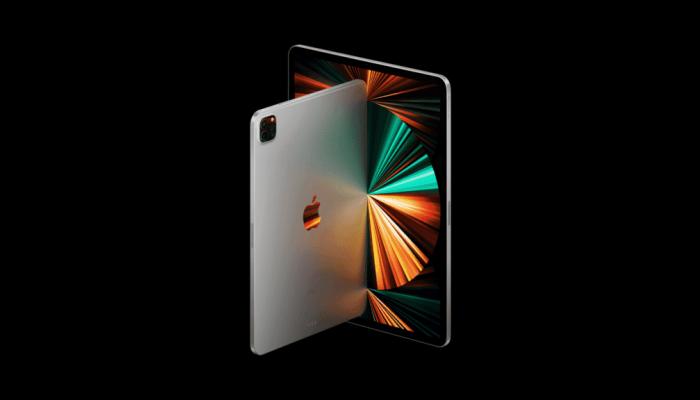

سعر جهاز ايباد برو 2021 (الجيل الخامس) بشاشة 12.9 انش وشريحة ام 1 سعة 256 جيجا وخاصية الواي فاي - رمادي سبيس فى مصر | بواسطة امازون مصر | كان بكام

تسوق سبايجن غطاء حماية ذكي وقابل للطي لجهاز أبل أيباد برو 11 بوصة (2021/2022) - أسود أون لاين - كارفور الإمارات